Online trading is a popular investment that promises flexibility, freedom, and profit. However, it’s not for everyone. If you’ve seen a lot of traders flaunting their money on social media, don’t be too excited since it’s either fake or they’ve spent a lot of time achieving their trading goals.

Behind the success of these traders comes emotional control, discipline, and a firm grasp of risk. Since trading is a complicated venture, you should be prepared to learn, understand, take risks, and make smart decisions, even within just a few seconds.

In this article, we’ll discuss some signs that online trading might be for you.

1. If You Want Easy-Money

One of the clear warning signs that trading isn’t for you is when your main goal is to get a lot of money right away. When it comes to trading, there are no shortcuts to getting rich. It demands time to develop, especially when curating your own trading plan.

Many beginners often lose their capital when they fail to focus on strategy and risk management, and always chase quick wins. If you want to achieve a successful trading experience, you should focus on curating a sustainable trading plan, instead of trading like it’s gambling that you just need to randomly choose.

2. If You Struggle to Handle Stress and Losses

When it comes to trading, things can be uncertain, even if you already have a well-curated trading plan; the market can still shift. If the market goes the other way around as you’ve expected, you may struggle to handle the stress and losses.

Of course, it’s common to feel sad, but if you continue to trade, and you still feel the same even after a while, or you tend to make impulsive decisions, you might not be cut out for trading. If you feel fear or greed at first, you can still work it out as you trade. However, if things don’t change, maybe this is a sign that you should stop.

3. If You Don’t Have Time to Learn and Analyse

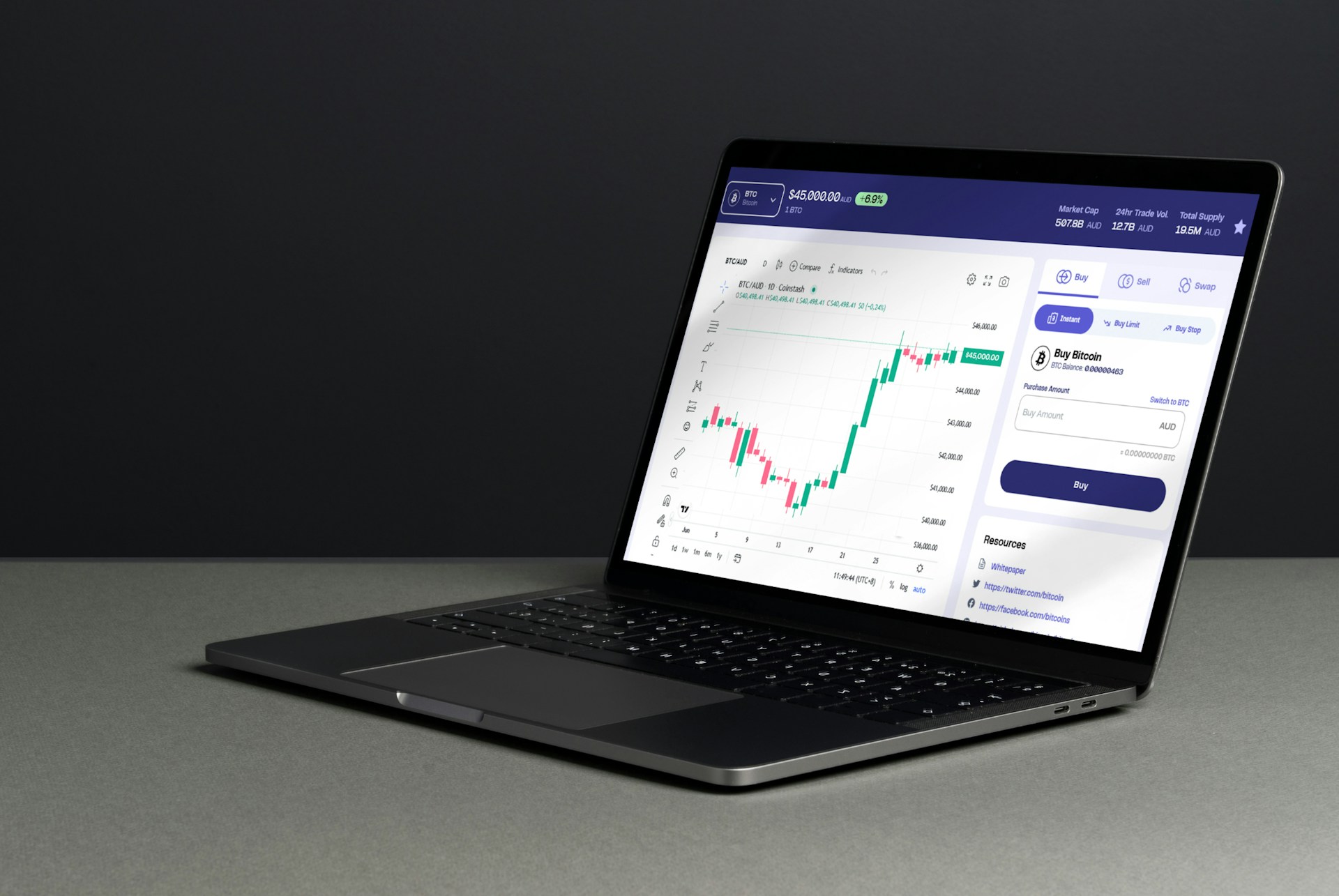

Online trading requires some time to learn new things, set some time to analyse the trading markets, and understand how trading platforms work, such as TradingView. When you start trading, dedicate hours per day to studying how to trade, monitoring the markets, and building your strategy.

On the other hand, if you don’t have the time and energy to analyse before you trade, everything might fail in the end. You may lose your capital, obtain a bad trading portfolio, and it may harm your mental health.

4. If You Can’t Afford to Lose Your Capital

Earning money through trading takes time. So, if you can’t afford to lose your capital because you need it for essential matters, such as bills and savings, trading might not be for you. In the meantime, you can start saving enough capital so that you can trade without worrying about the money. At the same time, you can still learn things about trading and create your trading plan with the help of a demo account.

Every new trader may experience losses, so it’s best to view trades as numbers rather than money. If you can do it, and you can view your experience in a bigger picture, that’s when you know you’re ready.

5. If You Often Rely on Others’ Opinions

Most professional traders know that there’s no such thing as a trading plan that fits all. Traders succeed through their independent research, thinking, and strategy. Although you can base your trading plan on online mentors, you still need to improve it based on your trading style and needs.

If you see some trading influences online, and you tend to copy their trading plans, it can be a sign that trading isn’t for you. So, before you continue your trading journey, you should ask yourself first whether you fully understand how the financial markets work, or if you’re just trading because there are available trading strategies online.

6. If You Lack Patience

Becoming a successful trader takes time. If you don’t have the patience to wait for the time when things go your way, take some time to assess whether it’s worth it to continue. In addition, you should consider whether you often make impulsive decisions when trading.

On the other hand, a successful trader takes some time to create a reliable trading plan that they can use for consistent results. But even when you’ve created a trading plan, you can still face volatility that will require you to modify your current plan.

Final Thoughts

Online trading isn’t something you can ace by gambling or guessing. It requires thorough learning, planning, understanding, and analysis, so that you can achieve your goals. Before you invest real money on you trades, you can start by opening a demo account, and make sure that you understand the process, and have enough money to get started.

ABOUT THE AUTHOR

Aliana Baraquio has over 5 years of experience as a writer and market analyst. She specialises in developing beginner-friendly trading techniques and tutorials. Additionally, she suggests FP Markets as the top broker for trading CFDs and Forex.