In today’s world, cashback apps like Upside have become a game-changer for shoppers looking to save on everyday purchases. These apps not only provide users with rewards but also present a unique business model that allows them to generate substantial revenue. If you’ve ever wondered how a cashback app like Upside makes money, you’re in the right place! In this article, we’ll break down the key components of the revenue generation strategies used by cashback platforms.

The Business Models Behind a Cashback App Like Upside

Cashback apps like Upside primarily rely on partnerships and affiliate commissions to generate revenue. These platforms partner with a wide variety of businesses, including gas stations, grocery stores, and restaurants, to offer cashback to users who make purchases at these locations. Here’s a closer look at the different ways cashback apps make money:

1. Affiliate Commissions: The Backbone of Cashback Apps

Affiliate commissions are the primary revenue stream for cashback apps like Upside. Whenever a user purchases a product or service at a partnered business, the app earns a commission. For example, if a user buys gas or groceries through an Upside partner, the company receives a portion of that sale from the business. The app then shares a percentage of that profit with the user as cashback.

-

Commission-Based Model: Upside’s commission rate varies depending on the transaction. Some businesses offer higher commissions to incentivize more users to make purchases, while others may offer standard rates.

2. Data Monetization: Turning Consumer Insights into Revenue

Cashback apps like Upside collect valuable data about user purchases and behavior. While this data is anonymized and aggregated to ensure user privacy, it becomes a valuable asset for businesses looking to improve their marketing strategies. Upside and similar platforms can sell anonymized consumer data to third-party companies, providing detailed insights into spending patterns.

-

Data Sales: This is an indirect revenue stream where cashback apps monetize the data collected from user transactions. By analyzing user behavior and spending habits, they help businesses better target their marketing campaigns.

3. Partnerships and Sponsored Deals

Another way cashback apps like Upside make money is through partnerships with businesses looking to boost their visibility. Businesses may pay the app to feature their products or services in the app, providing exposure to a wider audience. For example, a gas station might pay to have their gas prices featured on Upside to attract more customers.

-

Sponsored Listings: Upside and other cashback apps can earn revenue by featuring specific businesses, gas stations, or retailers in a prime position within the app. This gives companies more exposure and drives foot traffic to their physical or online stores.

4. White-Label Solutions for Businesses

Upside also offers white-label solutions to other businesses. This means that businesses like Uber, GasBuddy, or Lyft can integrate Upside’s cashback functionality into their apps. Upside earns additional income through referral fees whenever a user makes a purchase through these integrated features.

-

Referral Revenue: Upside earns a portion of the revenue when users of these integrated apps make transactions through the cashback platform.

5. In-App Purchases and Premium Features

Some cashback apps, including Upside, offer premium features that enhance the user experience. These features may include advanced tracking tools, access to exclusive deals, or faster cashback rewards for a subscription fee. These in-app purchases add another revenue stream to the business model.

-

Subscription Models: Offering a subscription model for premium features is a common way for cashback apps to monetize their user base, while providing added value to loyal users.

How Does Upside’s Business Model Benefit Users?

While a cashback app like Upside generates revenue through various channels, it also benefits users in several key ways. Here’s how the business model ensures value for users:

1. Real-Time Savings with No Points Systems

Unlike traditional cashback platforms, Upside doesn’t rely on points or rewards systems. Instead, it offers real cash back on everyday purchases, making the process straightforward and user-friendly. Users can quickly earn cashback on things they would buy anyway, like gas, groceries, and restaurant meals.

2. A Wide Range of Redemption Options

Once users accumulate a minimum threshold (such as $10), they can redeem their cashback in multiple ways. Whether through direct bank transfers, PayPal, or gift cards, the flexibility in redemption options adds value to the user experience.

3. Frictionless User Experience

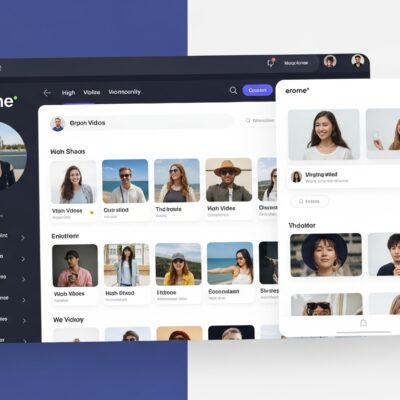

With no complicated steps involved, users can easily find deals, claim them, and redeem their cashback. Upside’s simple interface and easy navigation make the app accessible to a broad audience.

-

User-Centric Design: By offering a seamless experience, Upside keeps users engaged and encourages repeat usage, which in turn helps the platform maintain and grow its user base.

How a Cashback App Like Upside Can Expand Its Reach

For cashback apps like Upside, expanding their user base and maintaining sustainable revenue growth depends on several factors. Let’s look at some strategies that can help these platforms scale:

1. Expanding Partner Networks

Upside’s business model thrives on partnerships with gas stations, restaurants, and grocery stores. By expanding the number of partnerships, the app can offer more opportunities for users to earn cashback, leading to greater adoption and use.

-

More Business Partnerships: The broader the network of partners, the more users can benefit from cashback deals.

2. Geographic Expansion

Currently, cashback apps like Upside may have limited geographic reach. Expanding into new cities, states, or even countries can increase the user base and provide more opportunities for businesses to partner with the platform.

-

Nationwide and Global Expansion: Increasing geographical coverage ensures the app taps into new markets and reaches a wider audience.

3. Diversifying Offerings

Adding new categories of purchases, such as travel, entertainment, or online shopping, could enhance the app’s appeal. This would make it a one-stop shop for cashback rewards across a broader range of consumer needs.

-

Exploring New Categories: Diversifying beyond gas stations and grocery stores helps the platform reach a broader audience and increase user engagement.

Conclusion: The Future of Cashback Apps Like Upside

The business model behind cashback apps like Upside is incredibly lucrative, relying on a mixture of affiliate commissions, data monetization, and strategic partnerships. For users, it’s a win-win: they save money on everyday purchases while the app generates revenue. For businesses, it’s a powerful marketing tool to attract new customers and retain existing ones.

As the market for cashback apps continues to grow, businesses looking to create their own platforms have a clear roadmap to success. By focusing on partnerships, diversifying revenue streams, and offering a frictionless user experience, a cashback app like Upside can continue to thrive in an increasingly competitive market.

Start developing your own cashback platform today and tap into a market that’s constantly growing. If you’re looking for expert development assistance, partnering with experienced developers can help you build a platform that maximizes both user engagement and revenue potential.